The process of bankarization is transversal in the society, it requires the fulfillment of duties and the control of the economic players in order to guarantee the benefits to the population and not to create barriers.

The development of banking transactions, with the projection of increasing electronic payments, is a necessity for the Cuban economy; an inclusive process with mandatory participation and equal conditions for all economic agents. It must be implemented according to economic and technological conditions, not as an option, but as an obligation.

Resolution 111/2023 of the Central Bank of Cuba, in its second and third articles, defines the state and private economic agents to comply with the banking agreements of the aforesaid resolution; who, in equal conditions, are participants in the process of banking transactions aimed at reducing the manipulation of physical money and increasing the benefits of electronic operations.

» Article 2. The subjects of the resolution are state enterprises, superior economic management organizations, budgetary units, non-agricultural cooperatives, agricultural cooperatives, agricultural producers, individual farmers, commercial fishermen, micro, small and medium enterprises, local development projects, self-employed workers, artists and creators, the modalities of foreign investment and the associative forms created under the Law of Associations.

Article 3. The provisions of this resolution are applicable to natural or legal persons not included in article 2, if they carry out legally authorized commercial and service activities.

Bank Account and its Proper Use

The ownership of a current or fiscal bank account is the first step to be taken at the bank as a subject of the economy, whether state or non-state. «After obtaining the legal authorization of the corporate purpose, the representative(s) must go to the bank branch of the municipality of residence; in the case of private parties, they can make use of the virtual option Plataforma Única (Single Platform). José Rebollido Batista, Deputy Commercial Director of Banco de Crédito y Comercio (Bandec) in Cienfuegos, explains.

The correct use of this account is an important aspect in the development of the bankarization process. «The contract between the bank and the client, in relation to Resolution 111/2023 of the BCC, gathers the requirements to be fulfilled by the economic actor; such as the operability of collections, payments, deposits and withdrawals; in the physical modalities and the implementation of electronic operations». Explains the specialist.

«In this regard, it is important to note that cash deposits are made with a daily periodicity; if a longer period is negotiated with the bank, up to five days, if the income exceeds 100 thousand pesos, the next working day the client must present himself at the branch». The Bandec expert goes on to explain.

These cash inflows to the banking institution, in this case from economic agents, contribute directly to the circulation of money and thus to the granting of credit, as well as to cash outflows, such as the supply of ATMs, the payment of salaries and the guarantee of other account withdrawals.

Remote Transactions

Operating through electronic payment channels directly contributes to the process of bankarization of transactions, both to pay economic agents to suppliers, as well as to ensure the collection of goods and services from individuals.

On this basis, since the end of the 20th century, the Cuban banking system has offered the service of remote banking. «The Virtual Bandec system for the business sector, in addition to other digital channels developed for individuals, is an online connection that allows the client to consult income and expense accounts, make payments and transfers, as well as carry out multiple operations.» Susana Fernández Correa, Electronic Banking Manager at Bandec in Cienfuegos, speaks about the service.

«This bank is in great demand by those who operate it, but it is not yet used by all the subjects of the province. In addition to the benefits it offers, savings, security and economy; it also favors the control and transparency of operations, achieving a detailed record of movements from the opening of the account». Specifies Fernandez Correa.

Remote crediting of workers’ salaries to a Red Card is one of the procedures available from Virtual Bandec. «Direct debit of salaries is another of the services to be implemented by the economic operators in the process of bankarization. This modality for the settlement of salaries and other collective payments directly favors the reduction of human and material expenses, including those related to the handling, transfer and security of cash». The specialist points out.

Betting on Digitization, Not Zero Cash

Physical money in Cuban pesos retains its validity and functionality as a means of payment; therefore, the various denominations of coins and notes in force at the BCC can be used to purchase goods and services, but they are not the only option.

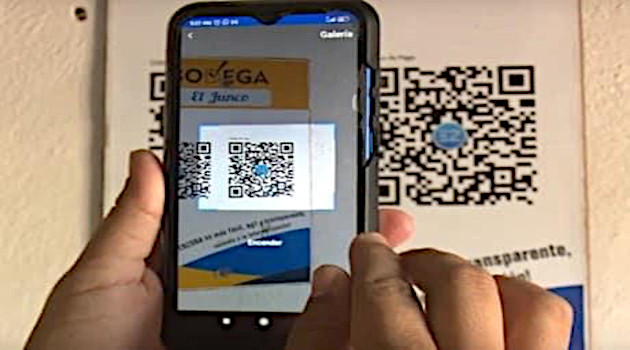

Modernity offers other options and electronic payment has its advantages. Online payment through the QR code is a cheaper alternative to charge consumers; for its implementation, the Cuban Telecommunications Company (Etecsa) and the Information Technology Company for Defense (Xetid) have digital ways to associate the establishment to electronic commerce.

«In Bandec Cienfuegos, we have, mainly with state sector entities, but also with MSMEs and self-employed workers, who comply with the process of bankarization; ensure digital payment, pay wages to workers by card, periodically deposit the cash received from sales; that is, they are well on their way to fulfilling their banking obligations; but it is not a widespread practice and in this we continue to work and educate them financially.» Fernandez Correa reports.

Bank accounts, deposits, means and channels of payment and credit granting, each service is a gear to the informatization of society, where the monitoring and requirement in each territory, company and legal business activity is essential to increase digital transactions in an interdisciplinary way and contribute to the Cuban economy.

Failure to comply with the obligations set forth in the resolutions in force and banking contracts may result in the closure of bank accounts and the commercial activity authorized to be carried out. (Taken from 5 de Septiembre newspaper)